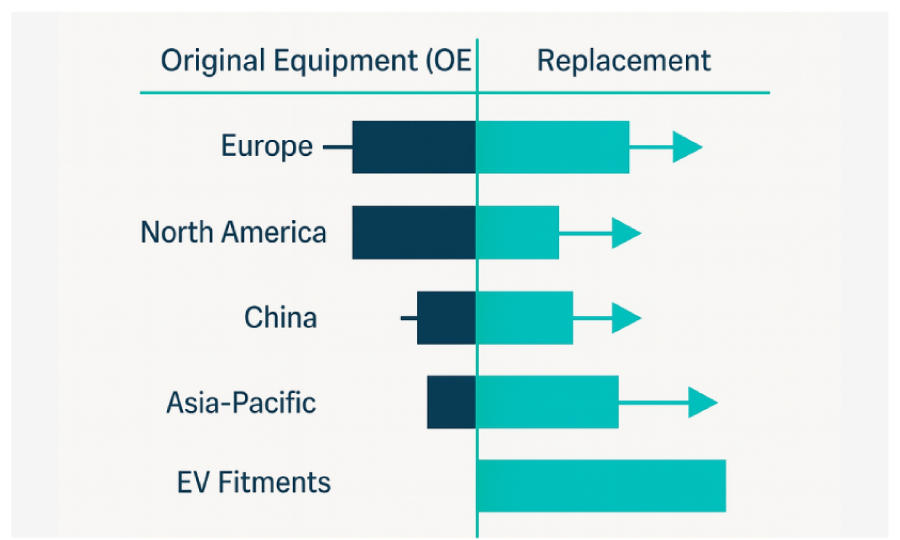

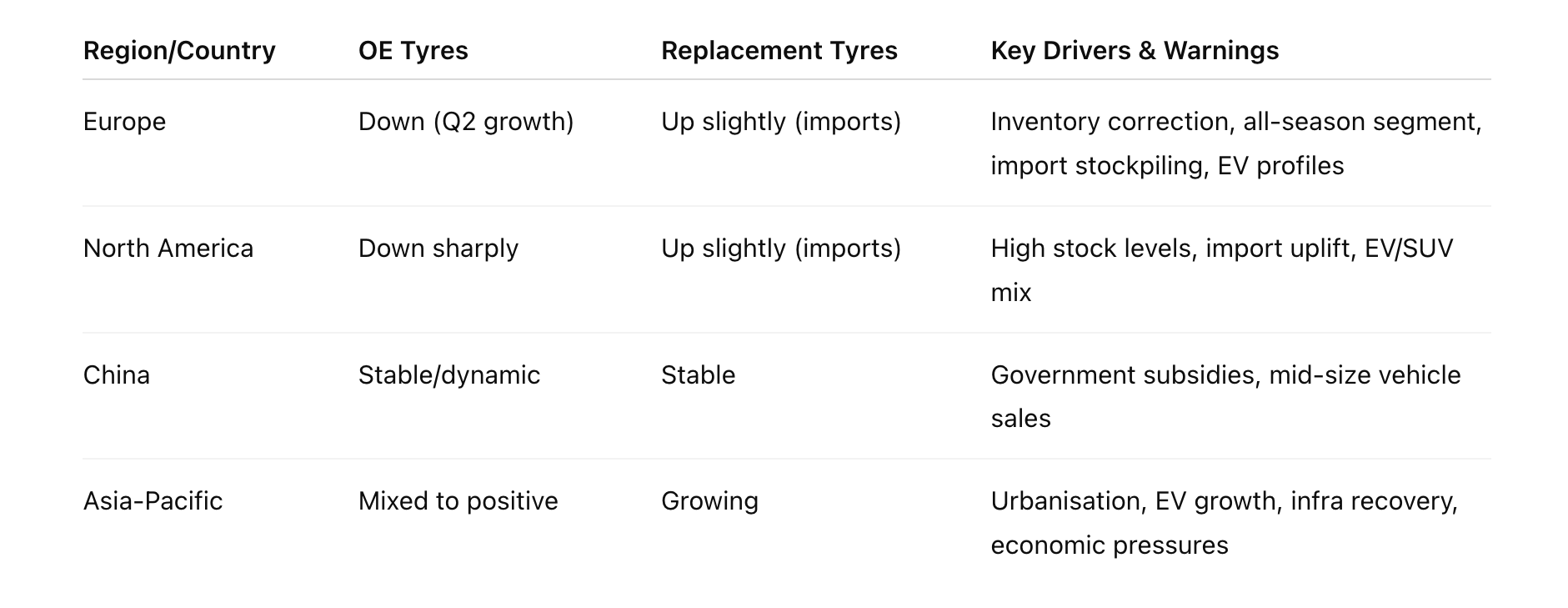

Tyre manufacturers reported uneven market trends in June 2025, with Original Equipment (OE) tyre sales continuing to decline in Europe and North America, while replacement volumes grew modestly, driven in part by pre-emptive imports and sustained demand for EV and SUV fitments.

Regional differences and shifting product mix remain key themes, alongside macroeconomic uncertainty and strategic trade responses, such as stockpiling ahead of tariff changes. Meanwhile, Asia and China continue to act as relative stabilisers in an otherwise fragile market.

OE demand in Europe remained down year-on-year, but showed signs of recovery in Q2 2025. Vehicle manufacturers continue to face slow registrations and high inventories, weighing on tyre demand.

Replacement tyre volumes rose slightly in June, particularly in the passenger car segment, driven by increased sales of all-season and value segment products. Growth was partly fuelled by imports ahead of anticipated tariffs, rather than a full return to pre-pandemic consumption.

Truck and agricultural tyre demand remained weak, reflecting slower construction and logistics activity.

OE tyre sales dropped sharply in June as production volumes slowed and dealers worked through stock overhangs. Replacement volumes ticked upward, with growth again linked to import-led sell-in rather than strong retail pull-through.

Demand remained focused on SUV and EV-compatible tyres, where value-tier and premium upsizing trends continued.

China’s OE and replacement markets were more stable in June, supported by sustained government subsidies for electric vehicles and demand for mid-sized vehicles.

Local production and consumer confidence helped maintain tyre market momentum, with domestic brands gaining share in both OE and replacement segments.

Asia-Pacific overall showed mixed performance. Some Southeast Asian markets reported gains tied to infrastructure recovery and urban mobility expansion, while others saw flat or mildly positive volumes.

The region continues to benefit from EV adoption and urban fleet demand, though remains sensitive to wider economic headwinds.

Several key forces shaped the tyre market in June:

Tyre industry outlook for H2 2025 remains uncertain. OE volumes may remain constrained by vehicle production cycles, while replacement markets could stabilise further, though growth will depend on end-user consumption catching up with current import-led stock positions.

Investments in EV-ready products, connected tyre systems, and sustainability programmes are expected to remain strategic priorities for all major players.

Tagged: tyre market, June 2025, OE demand, replacement tyres, EV tyres, tyre imports, Michelin, Pirelli, Bridgestone, Continental, Goodyear, Asia Pacific, smart tyres

Disclaimer: This content may include forward-looking statements. Views expressed are not verified or endorsed by Tyre News Media.